Alright, so here’s the thing—if you’re diving into the Solana ecosystem, you probably already know that staking and DeFi can be game changers. But man, the number of choices you gotta make? It’s dizzying. Which validator to pick? Do you really have to get a hardware wallet? And yield farming… well, that can be a wild ride. I’ve been messing around with this space for a while, and let me tell you, the devil’s in the details.

Validators aren’t just some faceless nodes; they’re the backbone of Solana’s network security and performance. Choosing one isn’t just about the highest APY. Nope. Reliability, reputation, and even their fee structure matter a ton. Sometimes I felt like I was playing a game of “hot potato” with my stake, switching validators the moment something felt off. But that’s not always smart either.

My gut said, “Just pick the biggest validator and chill.” But wait—actually, that’s not always the best idea. Big validators might seem safe, but decentralization gets murky if everyone piles onto the same ones. There’s this tension between risk and reward that I’m still trying to wrap my head around. On one hand, smaller validators might offer better yields or incentives, but on the other, they might be less reliable or slower to validate blocks, which can cost you.

Hardware wallets then enter the picture, and wow, they’re a total different beast. I mean, yeah, software wallets are convenient, but when you’re staking or yield farming with real money on the line, cold storage feels like a no-brainer. Something about holding your private keys offline gives me peace of mind that I can’t shake. But here’s a twist—integrating hardware wallets with Solana apps isn’t always seamless.

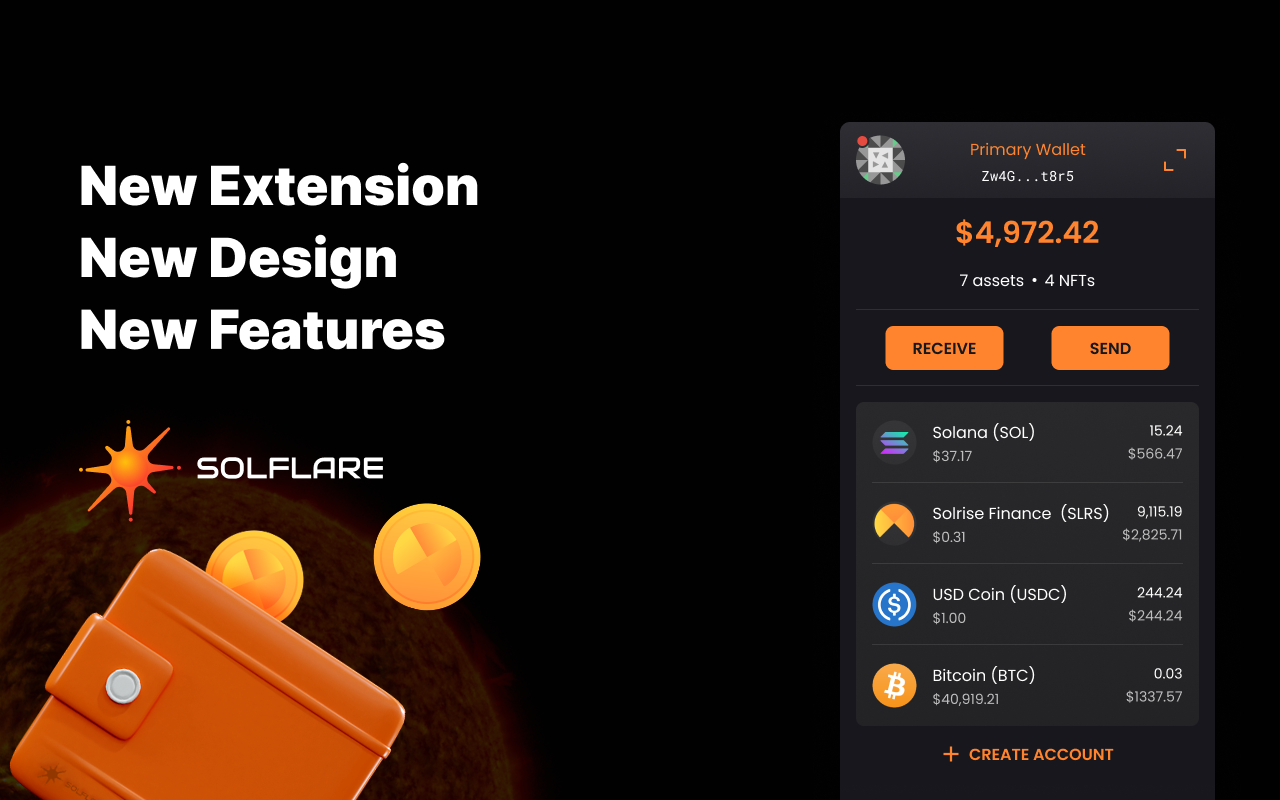

Check this out—using the solflare extension made my life way easier. It bridges that gap between cold storage security and smooth DeFi interactions. Seriously, it’s like having your cake and eating it too, with less risk of exposing your keys to sketchy sites. But I’ll admit, getting set up took me a minute, and I fumbled a bit with the interface at first.

Yield farming? Oh boy, that’s where the thrill and the headaches collide. I jumped into a couple of pools that promised sky-high returns, only to realize the impermanent loss and transaction fees sometimes ate up more profits than I expected. On top of that, you gotta watch out for scams and rug pulls—as tempting as shiny APYs are, they aren’t worth losing your principal for.

Initially, I thought, “Just follow the crowd, pick the hottest farm.” But actually, wait—let me rephrase that. It’s way better to research the tokenomics behind the farms, understand the project’s fundamentals, and monitor the network’s activity. I found that sticking with well-known, audited projects on Solana tended to be safer, though maybe less lucrative. On the flip side, some smaller pools can be gems if you’re willing to take calculated risks.

Here’s what bugs me about some staking platforms—they don’t make validator data transparent enough. You gotta dig around to find uptime percentages, commission rates, and community feedback. The Solana Explorer helps, but it’s not always user-friendly for newcomers. So yeah, I often rely on community forums and Twitter threads to get a sense of who’s legit and who’s not.

And speaking of community, there’s a vibe on Solana that’s pretty unique. The users are often super tech-savvy but also very cautious after last year’s market shakeups. That caution seeps into how folks pick validators and farms; they’re not just chasing the biggest numbers but looking for sustainability. I respect that. It’s like folks are learning the hard way that patience often beats greed here.

Why Hardware Wallets Matter and How Solflare Helps

Okay, so check this out—hardware wallets like Ledger or Trezor are essential if you wanna keep your crypto safe, especially for staking. The problem is, Solana’s ecosystem is a bit newer, so not all hardware wallets play nice with every dApp out there. That’s where the solflare extension shines. It’s designed to integrate smoothly with hardware wallets and the Solana network, which means you don’t have to sacrifice security for convenience.

At first I was skeptical—hardware wallets can be clunky. I mean, they’re physical devices you gotta carry around, and messing up a seed phrase is a nightmare waiting to happen. But once I got the solflare extension set up and linked my Ledger, things just clicked. The extension acts like a secure bridge, letting me stake, swap, and farm without exposing my keys. Plus, it supports multiple accounts, which is clutch for managing different portfolios.

That said, there’s a learning curve. Some transactions take longer to confirm because of the extra security steps. And you have to mentally prepare for the occasional prompt on your hardware device, which can feel slow compared to quick app approvals. But honestly? This trade-off is worth it when you consider what’s at stake.

On one hand, software wallets feel like the Wild West—super easy but vulnerable. Though actually, with software wallets like Phantom or even the solflare extension’s hot wallet, you get speed and convenience. But my instinct says cold storage trumps it for long-term staking and yield farming, especially if you’re serious about protecting your assets from hacks or phishing.

It’s funny—sometimes I catch myself wishing the whole process was simpler, but then again, crypto security isn’t supposed to be a walk in the park. You gotta respect the complexity, or else you end up learning the hard way.

Picking Validators: Beyond Just Yield

Validator selection feels like a puzzle with missing pieces. Most newbie guides scream “pick the highest yield!” but that’s just the tip of the iceberg. If a validator’s commission is low but they’re unreliable, your rewards might vanish in missed epochs or delayed payouts. Reliability stats, community reputation, and even geographic diversity of validators should factor into your choice.

Something felt off about blindly trusting validator lists that only rank by yield. I realized that sometimes smaller validators, maybe run by passionate community members, offer better transparency and communication. That counts for a lot when you wanna feel confident your stake’s in good hands. Plus, supporting decentralization helps the network’s health long-term.

On the flip side, there’s a certain comfort in sticking with those big-name validators. They often have more robust infrastructure and faster uptimes. But if everyone piles in, it kinda defeats the point of decentralization, which is core to blockchain’s value. So yeah, I juggle between safety and supporting smaller operators, which can get tricky.

Here’s a quick tip: use tools and dashboards that show validator performance over time, not just snapshots. I rely on Solana Beach and Solana Explorer, but I’m always cross-checking with community opinions. Trust but verify, you know?

Also, keep an eye on validator commission changes. Some validators adjust fees dynamically, which can affect your net rewards. It’s easy to miss if you just set-and-forget your stake.

Yield Farming—The Highs, The Lows, and The What-Ifs

Yield farming on Solana is tempting because of those juicy APYs, but whoa, it’s a rollercoaster. Transaction fees are low compared to Ethereum, which is great, but slippage and impermanent loss sneak up on you. There were times I jumped into a pool thinking I’d double my tokens fast, only to have fluctuating prices slash my gains.

At one point, I was farming a new token that promised 100% APY. My instinct said “too good to be true,” and it kinda was. The project faded, liquidity vanished, and I was left holding tokens nobody cared about. That was a hard lesson in patience and due diligence.

But here’s the thing—yield farming isn’t all gloom. When done right, it can turn your Solana holdings into a productive asset, earning passive income while you sleep. The key is picking farms with solid teams, clear utility, and decent liquidity.

Personal favorite strategy? Stick to stablecoin pools or blue-chip tokens for the bulk of my farming. It’s less flashy but often more sustainable. And I always use wallets that support hardware integration, like the solflare extension, so I’m not exposing my keys during all these DeFi maneuvers.

One last thing—staking rewards compound best when you reinvest, but reinvesting means more transactions. If you’re not careful, those fees start to add up and eat your profits. So I tend to batch my actions and avoid jumping in and out every day.

Honestly, yield farming requires a bit of emotional control, which is kinda ironic for crypto, right? You gotta resist FOMO and hype, and sometimes just sit tight.

Common Questions About Validator Selection, Hardware Wallets, and Yield Farming

How do I choose a good Solana validator?

Look beyond just the APY. Check uptime, commission rates, validator reputation, and community feedback. Tools like Solana Beach can help, but don’t forget to verify info across platforms and social channels.

Is a hardware wallet necessary for staking?

While not mandatory, hardware wallets add a strong layer of security, especially for larger stakes or long-term holdings. Pairing them with tools like the solflare extension improves usability without compromising safety.

What are the biggest risks in yield farming on Solana?

Impermanent loss, rug pulls, and volatile token prices top the list. Also, watch transaction costs and slippage. Always research projects thoroughly before committing funds.